Plans are investing in SNPs and executives need to prepare for scrutiny

Notwithstanding the huge meltdown in health insurance generally and Medicare Advantage (MA) specifically, MA plans are busy making new investments in the program, prognosticating that investments in Special Needs Plans (SNPs) will pay huge dividends.

Back in March of this year, I wrote a detailed blog on everything SNP – from what they are, the types, history, growth, regulation, and more. Go here to read the details, which are still very relevant: https://www.healthcarelabyrinth.com/special-needs-plans-snp-growth-a-relative-bright-spot-for-medicare-advantage-ma/ .

In this blog, I am updating some recent growth trends and I will further elaborate about why plans are investing here and some of the rising risks to consider. On Monday, I plan to do a deep dive into current audit and regulatory trends in SNPs to help plans and executives prepare for program audits.

A growth update

Plans have been investing heavily in SNPs for several years now and this occurred even with the financial woes many saw in 2024 that led to a massive retrenchment in terms of geographies, products, and benefits in 2025. As many mainstream MA products were contracting, SNP plans continued to see a rise in 2025. In essence, plans doubled down on SNP investments. Indeed, while individual MA plan offerings declined by 6.54% in 2025, SNP offerings increased 8.5% in 2025.

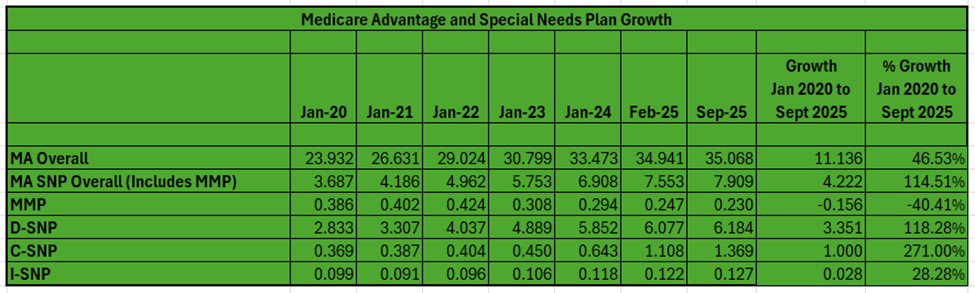

As can be seen in the chart below, the investments in SNPs have paid a huge dividend – at least in enrollment.

- From January 2020 to September 2025, SNPs grew from 3.687M to 7.909M, a growth of 4.222M or 114.51%. As explosive as growth has been for MA in general, SNP growth is about 150% more than MA overall or well more than double.

- About half of the growth noted above has come since January 2023.

- SNP enrollment grew about 264K in the 2025 enrollment season and has grown 356K since February. SNPs have dominated monthly MA gains in 2025. SNP growth is about 56% of all MA growth from February to September.

- The only category of SNPs that has lost enrollment is Medicare-Medicaid Plans (MMPs), state-federal demonstrations for dual eligibles that are being phased out at the end of this year. Most states are converting these plans into more integrated SNPs.

- Dual-Eligible or D-SNPs have dominated the numbers, capturing 3.351M of the 4.222M growth, or 79% of all growth. They grew 118% in the timeframe.

- Chronic Care or C-SNPs grew the most from a percentage standpoint in the timeframe, growing by 1M or 271%. What’s more: while D-SNPs dominated growth historically, just short of 75% of January 2024 to February 2025 SNP growth was in C-SNPs. Roughly the same percentage applies to C-SNP growth of all SNP growth since February.

- Institutional or I-SNPs have always been much smaller but have grown by 28% over the timeframe.

- As with MA overall, SNP enrollment generally is doiminated by the biggest national health plans.

Learn more about SNP types in the earlier blog I cited above. One important note is that while dual eligible SNPs are mandated to serve duals, the C-SNPs and I-SNPs by their nature can have concentrations of duals as well.

An interesting article recently on the major growth of C-SNPs. Authors in a Health Affairs Forefront blog argue that the growth in C-SNPs is creating a barrier for dual integration. They note that there are now 125,638 full-benefit dual eligibles and 86,815 partial dual eligibles in C-SNPs. About 28% of these 2025 full-benefit-dual-eligible beneficiaries were previously enrolled in a plan that offered some form of integration in the prior year.

I also noted above that C-SNP growth dominated SNP growth in 2025. Part of the reason is plans worrying about some of the costly requirements and complexities of dual integration. Further, the D-SNP “look alike” threshold was lowered for 2025, which probably played a role in C-SNP growth as well. Are C-SNPs becoming the new “look alikes” to overcome the lower regulatory penetration threshold?

Health Affairs blog here: https://www.healthaffairs.org/content/forefront/growth-c-snps-may-jeopardizing-medicare-medicaid-integration

Why are plans investing?

You can get all of the details in the first blog I cited above, but here is a quick cheat sheet.

- The Centers for Medicare and Medicaid Services (CMS) is prioritizing integration of Medicare and Medicaid and reducing dual eligibles costs and increasing quality. These requirements largely apply to D-SNPs and not C-SNPs or I-SNPs. Plans do not want to be left out of this growing population.

- As high as MA revenue is per member, SNP membership offers even greater per-member revenue due to various factors in the demographic portion of the rate-setting system (e.g., Medicaid status, frailty, etc.) as well as the clinical risk adjustment component (dual eligibles and SNP members tend to have multiple disease states).

- Many of the plans are also in Medicaid and see natural synergies (including the spread of administrative costs) between the Medicaid and Medicare lines of business.

So, done right, health plans can reduce costs dramatically against the traditional fee-for-service (FFS) program cost as long as they practice good clinical oversight and address social determinant barriers. If plans can reduce costs for SNP enrollees, the greater the opportunity for margin.

The risks plans could face

Now, I have argued SNPs are not for the faint of heart.There are clearly risks that actually could go well beyond mainstream MA. Too few plans think through these issues when they go into the SNP business.

- While the system offers great opportunity to gain additional revenue on dual eligibles, the current rate environment shows the risk inherent in the system. Plans need a robust claims and encounter system to ensure accurate and fulsome reporting of qualifying diagnoses to CMS. It is also true that risk adjustment is being reformed. The new v28 risk model certainly claws back revenue across all MA lives, even the higher-revenue dual and SNP lives. The risk adjustment data validation audits (RADVs) increases risks too. Both v28 and RADV will bring down per-member-per-month revenue on all members, but perhaps duals more so.

- If plans do not have the right clinical infrastructure and models, more revenue will not mean more margin. Poorly managed co-morbid disease states and social determinants could mean excessive and growing costs on SNP members.

- Several Star impacts are significant for SNPs and duals in general as well:

- SNPs carry three more Star measures to manage. While the Care for Older Adult measures have been performing well, some plans are struggling with the SNP-Care Management measures. The huge surge in enrollment is complicating completion of required health risk assessments (HRAs).

- More and more penetration of dual eligible and SNP members could lower overall Star performance. The Categorical Adjustment Index (CAI) does not adequately offset the impacts on quality achievement for plans with high concentrations of dual and SNP lives.

- The new Excellent Health Outcomes for All (EH04all or the former Health Equity Index) is a tall challenge to achieve an award on as it focuses on those with social determinant barriers to care. SNPs and those with major dual concentrations could have a very hard time here.

- A new rule could force plans to have their SNP lives in a free-standing contract. While this could help existing contracts’ performance, it could lower rebates and bonuses on SNP lives due to poor quality achievement, hurting the financial proposition.

- And most plans are paying too little attention to the emerging and robust SNP program audit protocols. It is a safe bet that CMS will increase audits of plans with SNPs. The audit protocols have become far more rigorous just in the past few years and that trend will continue. CMS does not view good clinical management through the lens of just a health risk assessment any longer. The agency wants ongoing diligence and oversight — continual tracking of risks, interventions, and outcomes to drive cost reduction and improve quality.

- And greater and greater integration – the map is already robust – could add significantly to both risk and administrative expense.

So, SNPs offer MA plans the ability to improve health outcomes while also registering a healthy margin. But running a SNP product requires superb regulatory and clinical execution as well as acute sensitivity to the ever-changing integration between Medicaid and Medicare. Despite the huge investment in benefits and marketing that is driving SNP growth, is every plan really read to tackle these significant barriers to success?

(Next week: a deep dive on SNP program audit trends and findings.)

Earlier SNP blog: https://www.healthcarelabyrinth.com/special-needs-plans-snp-growth-a-relative-bright-spot-for-medicare-advantage-ma/

— Marc S. Ryan