(NOTE: This blog was co-published with Lilac Software. Learn more at https://lilacsoftware.com )

Plans’ Star rating stabilized a bit but challenges remain

Last year at this time, the Medicare Advantage (MA) Star news for Star Year (SY) 2025 was a third drop in a row in Star performance from the peak in SY 2022. Here we are one year later and the picture is mixed. The three-year downturn in Star ratings appears to have ended, but SY 2026 was relatively flat to SY 2025. There has been little progress overall. While we see some signs of stability, it is fair to say that MA Star performance is still in the doldrums and the industry continues to have some of the lowest ratings ever.

One key fact showing continued challenges for plans with Stars

Star ratings overall remain at very low levels. Of the 481 MA contracts rated in both SY 2025 and SY 2026, about 29% (140) of contracts saw ratings drop a half a Star or more, 26% (125) of contracts saw ratings increase a half a Star or more, and about 45% (216) stayed the same.

Where do we see some recovery and better or at least stable performance?

Some measure performance improving: Some cut points, average measure values, and average measure ratings seem to show plans doing better over the past few years coming out of the COVID pandemic.

Contracts 4 Star or greater stable: In SY 2025, about 40% of all rated contracts were 4 Star or greater. For SY 2026, about the same 40% are in contracts with 4 Star or greater.

Enrollment in 4 Star or greater stable: In SY 2025, about 62% of all MA enrollment was projected to be in contracts with 4 Stars or more. That grew to 64% as of late. For SY 2026, it appears about 64% of all MA enrollment will be in contracts with 4 Stars or more.

Average Star rating slightly higher: Both the contract average rating and enrollment weighted average rating improved. The contract average rating went from 3.63 in 2025 to 3.65 in 2026. The enrollment weighted average rating went from 3.92 in 2025 to 3.98 in 2026. The 2025 enrollment-weighted average has grown to 3.96.

In summary, while things stabilized or did a little better, we are still in an era of very low scores. The enrollment-weighted average rating is below 4.0 and the number of contracts and enrollees in 4-Star or greater plans remains very low.

While we saw little rise in Star overall, is it possible that the impact of disaster designation stopped some contracts from dropping? And what might be the impact in SY 2027 if disaster designations go down? We may take a stab at analyzing this in the future.

How did big MA plans fare?

Big MA plan performance was a mixed bag. Some saw recovery but not to the levels of before. Others still slipped more. Here are the seven plans with the largest MA enrollment.

- United up: UnitedHealthcare 4-Star plus enrollment went up from 71% to 78%.

- Humana down: Humana 4-Star plus enrollment went down from 25% to 20%.

- Aetna down: Aetna 4-Star plus enrollment went down from 89% to 81%.

- Elevance up: Elevance Health 4-Star plus enrollment went up from 40% to 45%.

- Kaiser at stellar levels: Kaiser pretty much maintained 100% of members in 4-Star plus enrollment.

- Centene up: Centene saw its 4-Star plus enrollment go from about 1% to 19%.

- HCSC down: HCSC, which bought the Cigna Medicare lives in 2025, saw its 4-Star plus enrollment drop from 60% to 47%.

The continuation of poor performance is driven by the inconsistent performance of big plans, which are about three-quarters of all enrollment.

On the Insurtech side, Devoted and Alignment continued to do well. Clover Health, though, saw its largest contract dip below 4 Star. That contract has 97% of its members.

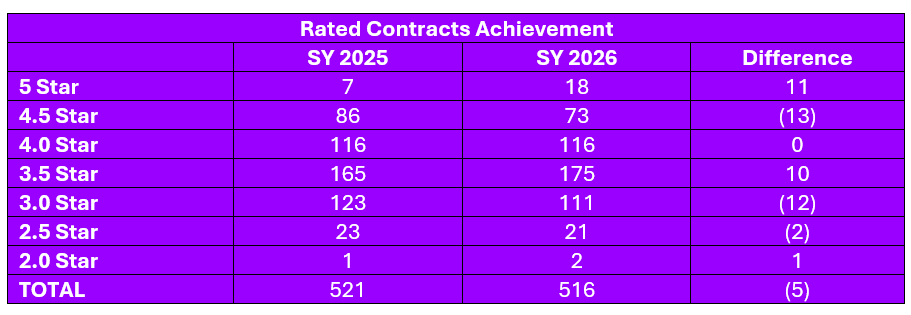

Looking at High, Medium, and Low Performance Here is a breakout of contract performance by Star rating between 2025 and 2026. For the purpose of our performance assessment, we bundled high performers as 4.5 and 5 Stars, medium performers as 3.5 and 4 Stars, and low performers as 3 and below Stars. The results:

We found that the number of 4.5 and 5 Star plans has dropped dramatically from 2022 to 2026, going from 168 in 2022 to 91 in 2026, a 46% reduction. For 3.5 and 4 Star plans, the count has increased from 268 in 2022 to 291 in 2026, a 9% increase. For 3 Star and below plans, the count increased from 27 in 2022 to 134 in 2026, a 396% increase.

As in the past there was volatility among the high performers. From SY 2025 to SY 2026, there were 36 new contract entrants to the exclusive category of 4.5 and 5 (91 contracts), while 38 contracts dropped out. Of those in the club before, 7 went up and 5 down.

Average Measure Scores

See the table at the end of this blog to see the changes in each measure’s average rating.

Star Year 2026 had 45 MA-PD measures — 33 Part C and 12 Part D. Three measures were new and did not have ratings in SY 2025.

In terms of Part C measures from 2025 to 2026:

- 13 measures increased, 6 stayed the same, and 11 dropped.

- Notable poorer or lower performing measures include: Breast Cancer Screening, Care for Older Adults – Pain Assessment, Improving Bladder Control, Plan All-Cause Readmissions, and Follow-up ED.

- Notable better or higher performing measures include: Colorectal Cancer (due to the guardrails), Controlling Blood Pressure, Medication Post-Discharge, Statin Therapy for Cardiovascular Disease, and Call Center.

In terms of Part D measures:

- 6 measures increased, 2 stayed the same, and 4 dropped.

- Notable high performing measures include: Call Center, Getting Need Prescriptions, MPF Accuracy, and Statin Use.

- Of note is that the three Medication Adherence measures declined or stayed the same and remained low-rated from 3.1 to 3.3. This is a problem area for plans, and these measures remain 3x weighted in SY 2027.

Challenges Moving Forward

- For SY 2027 (Measure Year (MY) 2025), two new tough medication measures have come online – Concurrent Use of Opioids and Benzodiazepines (COB) and Polypharmacy: Use of Multiple Anticholinergic Medications in Older Adults (Poly-ACH). The amount of time a member can have overlapping medications is very tight. Due to data lags, many plans often do not know members have overlapping days until they are already non-compliant for the measure for the year.

- For SY 2027, the Reward Factor is replaced with the Excellent Health Outcomes For All, (EHO4all, previously the Health Equity Index) is slated to award just 0.1 of 0.4 in the first year to plans, down from the annual average of 0.3 of 0.4 from the Reward Factor. The formulas for EHO4all are complex, using a blend of two years of performance on low-income/dual/disabled populations, enrollment growth impacts, and performance against all contracts.

- MY 2024/SY 2026 saw the first true NCQA electronic measure in Stars known as ECDS: Colorectal Cancer Screening (I don’t count Breast Cancer Screening for SY 2025 as it was not a hybrid measure). More will roll out over time. Performance on Colorectal was hugely challenging due to the conversion and the age band is expanded (from 50 to 45) in SY 2027.

- For MY 2024/SY 2026, Improving/Maintaining Physical Health and Improving/Maintaining Mental Health returned, and Kidney Health Evaluation was added. The Improving measures move to 3x weight in MY 2025/SY 2027.

- For MY 2025/SY 2027, Care for Older Adults-Functional Status returns. The chart review option for Diabetes Care — Eye Exam goes away.

Conclusion

SY 2026 continues the theme that Star achievement remains a huge challenge for plans big and small. COVID allowances led many plans to be complacent in a key revenue and competitive advantage area. That continued into SY 2025 and now to some degree in SY 2026. Plans lost focus and many have not rebounded.

What plans fail to appreciate too is the “long tail” of Star. The 40-plus measures for MA-PD plans are a curious concoction of clinical, drug, survey, and plan performance measures. Data used to calculate a given Star year may be one year back for CAHPS and two years back for HOS surveys, clinical measures, and plan performance metrics. Within the HEDIS clinical measures, the lookback for compliance can add one or more years as well. Once you get a Star score, it does not impact your revenue until the next year. So, what you did a year ago and do today impacts your Star score and revenue well into the future. What’s more, plans have to be working multiple Star years at once due to this lag. The point is that MA plans can never lose focus on the program, or they risk huge fallout well into the future.

Many plans lack the technology, clean and timely data, and expertise to hone a consistent and high-performing program. They also lack the agility to respond to CMS changes in the Star program. Technology to analyze and keep tabs on all the years, measures, and formulas is key.

The SY 2026 results signal continued tough financial times moving forward, complicated by risk adjustment reform and rate hikes that are not keeping up with utilization trends so far. Given ongoing poor performance on Star, Congress could reassess the program. MedPAC, the congressional policy arm for Medicare, is especially keen on changing the program in many ways. The fact that just 40% of contracts and 64% of enrollment is in 4-Star plus contracts is especially concerning.

But the problems can also be looked at as a positive and opportunity. The Star rating program is meant to be a continuous quality improvement program or process. We have such challenges on the cost and outcome front in healthcare that we cannot rest on our laurels and must continue to drive performance. In the end, that is what Star is all about.

So, in many ways, Star is working even with scores dropping recently or being stagnant in SY 2026. Star scores dropping can be seen as a sign that the Star program is doing exactly what we want as a nation and what CMS’ Star mandate is for MA – good quality care for members at a lower cost and increasingly better quality over time. So, while there will surely be more turmoil as a result of the SY 2026 announcement, we should keep this in mind and celebrate a commitment to quality. Plans need to meet the challenge.

| Average Measure Ratings Changes from SY 2025 to SY 2026 | ||

| SY 2025 | SY 2026 | |

| Breast Cancer Screening | 3.4 | 3.2 |

| Colorectal Cancer Screening | 3.4 | 3.8 |

| Annual Flu Vaccine | 3.2 | 3.2 |

| Improving or Maintaining Physical Health | NA | 3.2 |

| Improving or Maintaining Mental Health | NA | 3.2 |

| Monitoring Physical Activity | 3.1 | 3.1 |

| Special Needs Plan (SNP) Care Management | 3.4 | 3.5 |

| Care for Older Adults – Medication Review | 4.1 | 4.2 |

| Care for Older Adults – Pain Assessment | 4.2 | 3.9 |

| Osteoporosis Management in Women who had a Fracture | 2.7 | 2.8 |

| Diabetes Care – Eye Exam | 3.4 | 3.4 |

| Diabetes Care – Blood Sugar Controlled | 3.7 | 3.6 |

| Kidney Health Evaluation for Patients with Diabetes | NA | 3.4 |

| Controlling Blood Pressure | 3.0 | 3.4 |

| Reducing the Risk of Falling | 2.6 | 2.7 |

| Improving Bladder Control | 3.0 | 2.8 |

| Medication Reconciliation Post-Discharge | 3.6 | 3.8 |

| Plan All-Cause Readmissions | 3.1 | 2.9 |

| Statin Therapy for Patients with Cardiovascular Disease | 3.0 | 3.3 |

| Transitions of Care | 3.0 | 3.1 |

| Follow-up after Emergency Department Visit for People with Multiple High-Risk Chronic Conditions | 3.2 | 2.8 |

| Getting Needed Care | 3.3 | 3.4 |

| Getting Appointments and Care Quickly | 3.5 | 3.5 |

| Customer Service | 3.5 | 3.5 |

| Rating of Health Care Quality | 3.5 | 3.4 |

| Rating of Health Plan | 3.2 | 3.4 |

| Care Coordination | 3.6 | 3.5 |

| Complaints about the Health Plan (C) | 4.2 | 4.1 |

| Members Choosing to Leave the Plan (C) | 3.6 | 3.7 |

| Health Plan Quality Improvement | 3.6 | 3.5 |

| Plan Makes Timely Decisions about Appeals | 4.2 | 4.1 |

| Reviewing Appeals Decisions | 3.7 | 3.7 |

| Call Center – Foreign Language Interpreter and TTY Availability (C) | 4.0 | 4.2 |

| Call Center – Foreign Language Interpreter and TTY Availability (D) | 4.0 | 4.4 |

| Complaints about the Drug Plan (D) | 4.2 | 4.1 |

| Members Choosing to Leave the Plan (D) | 3.6 | 3.7 |

| Drug Plan Quality Improvement | 3.3 | 3.4 |

| Rating of Drug Plan | 3.4 | 3.3 |

| Getting Needed Prescription Drugs | 3.3 | 3.5 |

| MPF Price Accuracy | 3.4 | 4.6 |

| Medication Adherence for Diabetes | 3.2 | 3.1 |

| Medication Adherence for Hypertension | 3.3 | 3.3 |

| Medication Adherence for Statins | 3.3 | 3.2 |

| MM CMR | 3.7 | 3.7 |

| Statin Use in Persons with Diabetes | 2.8 | 3.3 |

#medicareadvantage #stars #quality #cms

— Marc S. Ryan