A quick blog to tell you about enrollment growth in Medicare Advantage (MA) in December 2025. The results show some interesting trends as we go into 2026. Many have predicted that MA enrollment could contract in 2026. I have said on a number of occasions that I doubted we would see that and instead see enrollment that is relatively flat or extremely small in terms of growth. I surmised that while most national plans want to see their enrollment contract by millions, I suspect regional plans will take on the challenge of enrolling robustly despite some financial risks. While it is too early to tell what will happen, we can read some tea leaves in the December data.

What do the latest statistics show?

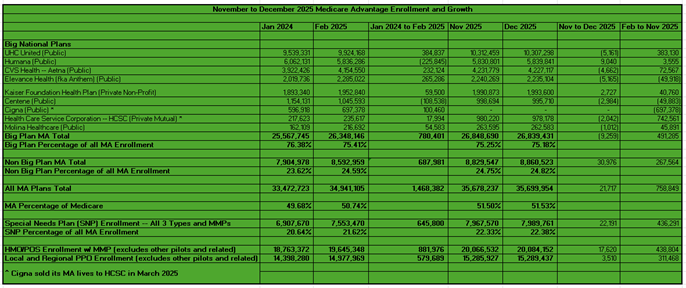

Growth from January 2024 to February 2025 was 4.39% or 1.468 million. (I used February 2025 because of issues with the January 2025 statistics.) Enrollment in MA reached 34.941M in February 2025. In December 2025, it reached 35.7M, growing a very small 22K. MA grew in November by about 49K. MA has grown by about 759K from February to December.

December is usually a small growth month even though it is in the open enrollment season. In December 2024, enrollment grew by about 20K.

How did Big MA do?

From January 2024 to February 2025, Big Plan MA enrollment performed very poorly because of retrenchment among some of these plans. Big MA grew by about 780K or 3.1%. Big MA enrollment hit 26.348M. This compares with about 688K growth or 8.7% for all other MA plans. All other MA plans grew to 8.593M in February 2025.

Big MA’s penetration dropped from 76.4% in January 2024 to 75.4% in February 2025. Big MA has grown about 491K lives from February to December 2025, or about 65% of growth in that timeframe. This trails Big MA’s overall penetration and its share has dropped o 75.2%. Big MA contracted in December by about 9K. Non-big MA plans grew by about 31K in December. This is an interesting trend. In December 2024, big MA contracted by about 5K, with non-big MA growing by 25K. So non-big MA plans actually grew more and big MA plans contracted more in December 2025 vs. December 2024.

United Healthcare contracted by about 5K in December 2025. United has grown about 383K since February. Because of United’s major financial troubles, United announced it was terminating most MA commissions as of July 1 (and will continue this into 2026). This was supposed to help stem additional growth throughout the rest of 2025. That is now happening and United wants to shed 1 million lives in 2026.

Humana realigned in 2025 and is looking for enrollment growth in 2026. Humana is said to be doing well among the big plans for 2026 signups for January 1. It grew by about 9K in December and is up just about 4K since February.

CVS contracted by about 5K in December and has grown about 73K since February. It also does not want to grow due to its efforts to right its financial ship, but enrollees in 2025 have been attracted to its benefits despite its pullback.

Elevance Health, another plan cutting commissions, contracted by 5K from December and has dropped about 50K since February.

Kaiser grew by about 3K in December and 41K since February. Centene dropped by about 3K in December and about 51K since February.

In March, Cigna closed its sale of its Medicare assets, including its over 700K MA lives, to Health Care Service Corporation (HCSC). As such, HCSC jumped from about 239K in March to 957K in April. It is now the 7th largest MA player. It grew by about 24K from May through November. It contracted by about 2K in December and now has about 978K members.

Molina dropped by about 1K in December and has grown by about 46K since February (almost entirely due to its acquisition of ConnectiCare).

Special Needs Plans chugging along

Special Needs Plans (SNPs) (including retiring MMP demonstrations) have seen great growth throughout 2025. From January 2024 to February 2025, SNPs grew to 7.553 million, a gain of about 646K or 9.35%. SNP enrollment grew about 264K in the 2025 enrollment season. But this growth is still down from the January 2023 to January 2024 period. In that period, SNPs added 1.154 million or 20.1%.

SNPs grew by about 22K in December. Almost all net growth in the month was in SNPs. SNPs added 436K lives from February to December. SNP growth is about 57% of all MA growth from February to December. Since October 2024 (when the 2025 enrollment season began), SNPs have grown by about 752K.

PPOs vs. HMOs

Over the years, PPOs began growing and competing well with HMOs in terms of raw numbers as well as percentage growth. While PPOs’ sheer number and percentage growth was beating HMOs over the past several years, that trend changed from January 2024 to February 2025. From January 2023 to January 2024, HMOs grew about 853K (4.8%) and PPOs 1.861 million (14.8%). But from January 2024 to February 2025, HMOs grew more than PPOs in terms of numbers and percentage: HMOs up about 882K (4.7%) vs. PPOs up about 580K (4%). HMOs grew by about 480K during the 2025 enrollment season, while PPOs contracted by about 58K.

From February to December, HMOs grew by about 439K while PPOs grew by 311K. In December, HMOs grew by about 18K while PPOs grew by just 4K. Plans have cut PPO offerings dramatically for 2026.

Conclusion

A few key takeaways here:

— Enrollment was predicted to contract for 2026. We don’t know yet, but December 2025 enrollment growth was about the same as December 2024.

— As with 2025, non-big MA plans seem to be readying to steal more lives from big national plans. Big MA contracted in December by about 9K. Non-big MA plans grew by about 31K in December. In December 2024, big MA contracted by about 5K, with non-big MA growing by 25K. So non-big MA plans are growing more going into 2026.

— Enrollment numbers show the huge SNP investments plans are making in both 2025 and 2026. Over 750K have been added to the SNP rolls since October 2024. SNPs accounted for basically all of the net growth in December 2025.

#medicareadvantage #enrollment #cms #healthplans #coverage

— Marc S. Ryan