Crushing costs may mean a relook at comprehensive coverage

Zeke Emmanuel, one of the key authors of the Affordable Care Act (ACA), had an interesting opinion piece in The Washington Post on December 2. He articulates many of the same things I say in my book, The Healthcare Labyrinth, and offers a blueprint in part for lasting reforms. A key one is price reform – one of my three tenets of healthcare reform (which also include comprehensive coverage and primary care and care management).

On price, Emmanuel notes that hospital prices have risen faster than any other sector since 2000. I have made the case that hospitals are entirely unaccountable, and they control more than just emergency rooms, outpatient, and inpatient care. They have taken over at least half of physicians in the country and have gutted independent primary care and changed practice patterns to encourage use of high-cost hospital-owned settings. Emmanuel is right that site neutral payments are an answer. He also wants commercial price caps. Commercial rates “piggy back” on Medicare rates and employer plans pay exponentially more than Medicare. Plenty of studies show that efficient hospitals can make money on Medicare and Medicaid as well as commercial rates that are just slightly higher than Medicare. The problem: hospitals are among the most powerful lobbies on Capitol Hill and have bought off Democrats and Republicans alike to maintain high-price policies.

Will lawmakers finally realize, though, that it is not nasty insurance companies that are making care unaffordable, but high costs throughout the system, principally driven by hospitals?

Emmanuel also encourages the following:

- Value-based payments. (In the physician world I like partial and global risk arrangements to align providers on reducing costs and improving quality.)

- Requiring insurers to offer the same prices for all customers. I have discussed another major topic that Emmanuel mentions – that insurers essentially charge self-insured employers (who are at risk for healthcare) more than what they pay providers if the plan is at risk for costs. This is very much hidden from employers. I have argued that fixing prices across lines of business regionally or nationally would encourage efficiency and reduce commercial costs.

- Pharmacy benefit manager (PBM) and drug reform in general.

- Leveraging technology and other reforms to reduce administrative complexity and costs. That cost — $340 billion annually.

Some good developments

All is not dire on the healthcare reform front. Here is some credit where credit is due to the Trump administration.

The president has done a good job of pushing drug price reform down the road. A series of executive orders encourage fulsome reform of the drug channel and on price. While I think President Trump needs to push further and not settle for deals with Big Pharma, those deals begin to reset the table on drug price in America, including reductions here and higher prices in other developed countries. On higher prices in other countries, I was amazed that Trump’s tariff plan actually gained higher prices in the U.K. The second round of Medicare drug price negotiations netted more than round 1 under President Biden – perhaps double Biden’s 22% net reduction. Demands for abandoning rebates and greater transparency led to budding reforms there. Interesting, too, is the fact that Trump’s concessions on drugs now have brand makers ready to sell directly to employer groups at discounted prices.

A Trump rule also took yet another baby step on site neutral payments. The outpatient reimbursement for drug administration services (such as chemotherapy) will be reduced by 60% when provided in off-campus hospital outpatient departments (HOPDs). Earlier, payments were reduced for services provided in relatively new off-campus HOPDs (beginning in 2017) and for clinic visits provided in all other off-campus HOPDs (beginning in 2019).

Applying site neutral policies to all hospital outpatient billing would save at least $157 billion over ten years. More importantly, huge savings would also occur in the commercial world as those rates are based on Medicare.

In a related move, CMS also is phasing out the inpatient-only list over a three-year period and expanding the Ambulatory Surgery Center (ASC) covered procedures list.

The Trump administration has also sought to reform the out-of-control 340b program that does little to control drug prices and has become a slush fund for hospitals.

Capitol Hill update

Will they or won’t they pass some sort of Exchange enhanced subsidy extension? Will it come with other reforms conservatives want? A vote is expected this week in the Senate on a Democratic proposed bill that would simply extend the enhancements for three years. There could be enough GOP senators to vote for the bill, but I would guess the vote will fall short of 60 votes. In the House, moderate Republicans could team up with Democrats to force a vote on an extension using the discharge petition process.

At the same time, the GOP is trying to gain consensus on something that will satisfy both conservatives and moderates. The House GOP says it may have a bill this week. The Senate is working on a bill as well but they may or may not have it completely ready for the promised subsidy extension vote this week. Trump was thought to be preparing an enhanced subsidy extension plan, but it is either delayed or won’t happen due to opposition from GOP conservatives in Congress.

The leading reforms, from Trump and most conservative lawmakers, include expanding Health Savings Accounts (HSAs) and perhaps sending some of the current enhancement money to “seed” these accounts for certain individuals. More radical ideas include partially repealing the ACA by stopping premium subsidies altogether and having individuals use tax credits to purchase coverage on their own.

Today, two competing Senate bills were introduced, showing an indeological divide in the Senate GOP. Bernie Moreno, R-OH, and Susan Collins, R-ME, introduced a bill with a two-year extension of the enhancements with some conservative reforms – an income eligibility cap at $200,000, minimum premiums of $25 per month, and fraud reforms. The main competing proposal is from HELP Chair Bill Cassidy, R-LA, and Mike Crapo, R-ID, doesn’t extend the subsidies at all. Instead, it would redirect that money into Health Savings Accounts paired with bronze or catastrophic plans on the Exchanges. Certain ACA enrollees earning less than 700 percent of the federal poverty level would receive $1,000 in an HSA if they’re 18 to 49 years old, and $1,500 if they’re 50 to 64. The Cassidy-Crapo bill will likely become the favored bill by most Republicans.

I do think Congress, and in particular the GOP, will need to do something on the Exchanges before the midterms. Too many Americans rely on subsidies and coverage in the Exchanges. A compromise bill could loo like the Collins/Moreno proposal.

The real problem with the GOP ideas is that individual options will take some time to set up. There are a matter of weeks before a huge premium hike in the Exchanges goes into effect and the HSAs would undermine the stability of the Exchanges, which could hike premiums even more over time. A healthcare policy group KFF poll finds that as many as one in four Exchange enrollees could go without coverage if enhanced subsidies sunset and premiums double. But read on for my discussion of affordability and why some of theGOP ideas should be considered.

While Democrats appear to have the political upper hand on healthcare issues, more and more studies do seem to substantiate that unfettered and free access to government programs leads to improper enrollment and fraud. Fraudulent enrollment in the Exchanges seems well-documented by think tanks like the Paragon Health Institute, the Centers for Medicare and Medicaid Services (CMS) and most recently the Government Accountability Office (GAO). A brewing $1 billion fraud scandal in Minnesota also raises concerns about Medicaid program expansions and accountability.

But real reform does not appear to be on the horizon, save for the moves Trump has made administratively and by some very smart bullying as well as perhaps reform coming for PBMs.

Is it time to rethink what comprehensive coverage is?

Most of you know I am a comprehensive insurance guy. I continue to believe sufficiently robust insurance and subsidies to help those in need purchase healthcare is a good idea. But I am beginning to redefine in my mind what comprehensive coverage is? Why? Because even with the Exchanges and expanded Medicaid, our uninsured and underinsured crisis has not waned. Yes, it will increase due to the effects of the One Big Beautiful Bill Act (OBBBA) over time.

But my issue is the here and now. Price, costs, and premiums have been increasing dramatically (6% to 9%, if not more) annually, putting coverage out of reach. Many Americans simply cannot afford premiums in the employer world. Many of those who can pay the premiums cannot afford to use their insurance appropriately. With a family insurance bill hitting almost $27,000 annually, we have a huge problem.

Consider, too, the plight of Medicare beneficiaries, most of whom are on fixed incomes. CMS released its annual updates for traditional Medicare Part A and B premiums deductibles and cost-sharing. There was a huge surge in Part B premiums monthly by almost 10%. The Social Security cost-of-living increase was just 2.8% or about $56 per month on average. The Part B premium increase will eat up $18 of that. Part B costs are paid 25% by enrollees via premiums and cost-sharing, while the government covers 75%. So, the 10% hike in Part B premiums shows just how out of control traditional Medicare really is. It is now a $1 trillion plus behemoth and growing dramatically each year despite huge holes in the actual benefit and an antiquated traditional fee-for-service (FFS) component.

The price reforms I discussed above would bring the cost of insurance down and make it far more affordable. But in the meantime, do we need to think more broadly about insurance and entertain changes to minimum essential coverage in the ACA? The OBBBA did create some pathways to rethinking such coverage over time. Bronze and Catastrophic plans on the Exchanges are now considered HSA-compatible HDHPs, allowing enrollees to open and fund HSAs o help cover costs tax-free. Direct Primary Care (DPC) is now an eligible HSA expense and DPC coverage does not disqualify someone from having an HSA. These and other reforms seem like reasonable ways to get people covered with some insurance or at least some coverage, especially if they cannot afford insurance or afford to use traditional insurance. These types of products also appeal to a younger generation, which is suspicious of traditional coverage and insurers. They prefer individualized care that may be on-demand via technoogy and cover lifestyle and well-being items.

New ACCESS model makes sense

CMS also announced a new Medicare FFS pilot to test chronic care management. The ACCESS (Advancing Chronic Care with Effective, Scalable Solutions) model tests an outcome-aligned payment approach in Medicare. The model is aimed at expanding access to new technology-supported care options that help people improve their health and prevent and manage chronic diseases. The model will cover conditions affecting more than two-thirds (tens of millions) of people with Medicare, including heart disease, diabetes, obesity, kidney disease, chronic musculoskeletal pain, and depression. It will run for 10 years beginning July 1, 2026 and will have voluntary enrollment.

Traditional Medicare doesn’t cover many digital tools, pays only for visits (not outcomes), has little or no care management. It has barriers to remote monitoring, digital therapeutics, and behavioral support. The technology-supported, proactive, continuous care ACCESS model has payments tied to outcomes rather than just volume.

It allows providers to use any tech-enabled care approach — telehealth, remote patient monitoring, digital therapeutics, care coordination, apps, devices. Providers receive predictable, recurring payments. Full payment is earned only when patient outcomes improve (e.g., blood pressure is under control, diabetic Hba1c tests improve, pain is reduced, and depression scores are better).

Now I have been suspicious of the proliferation of traditional Medicare pilots. Most have been unsuccessful, haven’t saved, and didn’t lead to better quality. For example, even one pilot focused on a disease state was a huge failure. Over six years, the much-ballyhooed diabetes prevention program enrolled only about 9,000 people out of millions eligible. I have encouraged CMS to collapse the number of pilots out there and focus on a few.

But CMS is on to something here. Uncontrolled disease states account for a huge share of spending on healthcare and this is particularly true in Medicare. A recent study in the Journal of the American Medical Association found that disease states are poorly managed in America. Forty-three percent of patients with diabetes and heart disease are not treated at all with evidence-based treatments and only 20% are treated adequately based on evidence. So, attacking the disease state problem is key. And testing the emerging role of technology to do so is key too.

Trump attacks health plans

A victim of the affordability debate appears to be health plans. President Trump has turned to attacking health plans in the wake of a concerted effort from Democrats accusing him and the GOP of not doing enough to tackle affordability.

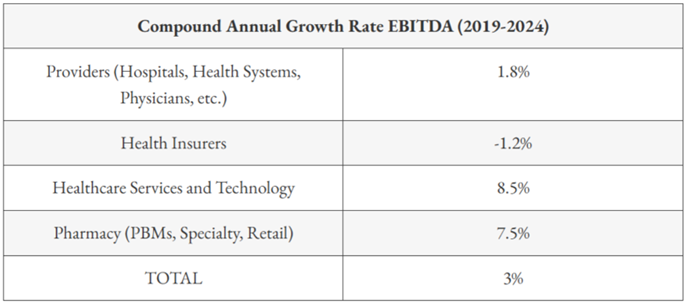

In a recent social media post, Trump directed his ire on affordability on health plans, saying: “The only healthcare I will support or approve is sending the money directly back to the people, with nothing going to the big, fat, rich insurance companies, who have made $trillions, and ripped off America long enough.” Of course, that is not true. As the graphic at the end of the blog shows, health plans are under water in terms of margin. They average no more than about 5% in good times due to administrative cost and margin caps. Other healthcare entities make far more than health plans.

But Trump may have the pulse of the nation. A recent poll determined 63% of those surveyed saying insurance companies were the most responsible for medical debt and 76% saying they want the country to switch to a different health insurance system in which they can be unemployed or self-employed and still remain insured. And 74% in anotheraf poll said they were in favor of Congress extending the credits rather than letting them expire. But when asked if they should be extended when reminded they were enhanced during the COVID pandemic, support drops dramatically.

#exchanges #coverage #healthcare #healthcarereform healthplans #trump #coverage #siteneutral #hospitals #medicare

— Marc S. Ryan