MA continues plugging along despite financial woes

A quick blog to tell you about enrollment growth in Medicare Advantage (MA) from August 2025 to September 2025.

MA growth slowed down from 2024 to 2025 because of the financial woes of the MA industry. But the rolls are still growing due to aging and the popularity and value of MA compared with the archaic traditional Medicare (fee-for-service) program.

What do the latest statistics show?

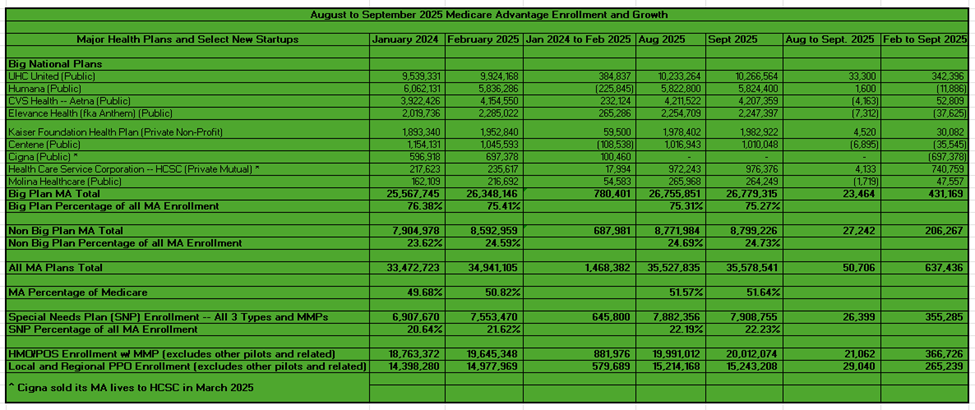

Growth from January 2024 to February 2025 was 4.39% or 1.468 million. (I used February 2025 because of issues with the January 2025 statistics). Enrollment in MA reached 34.941M in February 2025. In September 2025, it reached 35.579M. MA enrollment grew about 51K from August to September and about 637K from February to September. Growth in September was down from 91K in August.

How did Big MA do?

From January 2024 to February 2025, Big Plan MA enrollment performed very poorly because of retrenchment among some of these plans. Big MA grew by about 780K or 3.1%. Big MA enrollment hit 26.348M. This compares with about 688K growth or 8.7% for all other MA plans. All other MA plans grew to 8.593M in February 2025.

Big MA’s penetration dropped from 76.4% in January 2024 to 75.4% in February 2025. Big MA has grown about 431K lives from February to September 2025, or about 68% of growth in that timeframe. This trails Big MA’s overall penetration. Big MA growth in September was about 23K, compared with 58K in August.

United Healthcare grew by about 33K in September 2025 (down from 39K in August) and about 342K since February. Because of United’s major financial troubles, United announced it is terminating most MA commissions as of July 1. This was supposed to help stem additional growth throughout the rest of 2025. But it is still growing. It clearly does not want to grow given its financial condition but continues to have the best benefits in 2025 for large MA plans.

Humana was basically flat in both August and September and has contracted by about 12K since February.

CVS contracted by about 4K in September after growing by about 13K in August. It has still grown about 53K since February. It also does not want to grow due to its efforts to right its financial ship, but enrollees have been attracted to its benefits despite its pullback.

Elevance Health, another plan cutting commissions, contracted by 7K in September and has dropped about 38K since February.

Kaiser grew by about 5K in September and 30K since February.

Centene dropped by about 7K in September and about 36K since February.

In March, Cigna closed its sale of its Medicare assets, including its over 700K MA lives, to Health Care Service Corporation (HCSC). As such, HCSC jumped from about 239K in March to 957K in April. It is now the 7th largest MA player. It grew by about 5K in May, 3K in June, 3K in July, 5K in August, and 4K in September.

Molina contracted by about 2K in September but has added about 48K since February (almost entirely due to its acquisition of Connecticare).

Special Needs Plans chugging along

Special Needs Plans (SNPs) (including MMPs) continued to see a healthy increase in enrollment. From January 2024 to February 2025, SNPs grew to 7.553 million, a gain of about 646K or 9.35%. SNP enrollment grew about 264K in the enrollment season. But this growth is still down from the January 2023 to January 2024 period. In that period, SNPs added 1.154 million or 20.1%.

SNPs grew an amazing 102K from May to June. SNPs added another 42K from June to July and yet another 42K from July to August. From August to September, SNPs grew about 26K. From February to September, SNPs added 355K more lives. SNP growth is about 56% of all MA growth from February to September. Including enrollment season growth through September, SNPS have grown about 619K.

PPOs vs. HMOs

Over the years, PPOs began growing and competing well with HMOs in terms of raw numbers as well as percentage growth. While PPOs’ sheer number and percentage growth was beating HMOs over the past several years, that trend changed from January 2024 to February 2025. From January 2023 to January 2024, HMOs grew about 853K (4.8%) and PPOs 1.861 million (14.8%).

But from January 2024 to February 2025, HMOs grew more than PPOs in terms of numbers and percentage: HMOs up about 882K (4.7%) vs. PPOs up about 580K (4%). HMOs grew by about 480K during the enrollment season, while PPOs contracted by about 58K.

From February to September, HMOs grew by about 367K while PPOs grew by 265K. From August to September, though, surprisingly HMOs grew by about 21K compared with 29K for PPOs. In August, HMOs grew by about 47K compared with 43K for PPOs.

#medicareadvantage #enrollment #cms #healthplans #coverage

— Marc S. Ryan