February 19, 2026

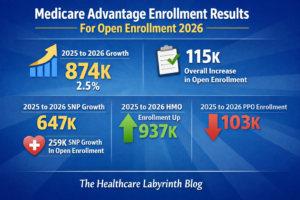

SNPs Up; Major Plan Terminations In MA Two new articles on the 2026 open enrollment season in Medicare Advantage (MA). A Modern Healthcare analysis says membership in Special Needs Plans, or SNPs, is now 8.2 million as of Feb. 1, up 12.2% from a year before. While enrollment growth overall slowed from 2025 to 2026, SNP growth actually went up. SNP growth was 10.1% in 2025. About a quarter of all enrollees are now in SNPs. A study in JAMA examined the major contraction in MA and rates of forced moves. It found that one in 10 MA enrollees were forced to disenroll from their current product choice heading into 2026 due to insurer exits or contractions. That is a ten-fold increase from historic averages and is up from 6.9% in 2025. Among the 28.6 million MA enrollees that were part of the study sample, 2.9 million were forced to