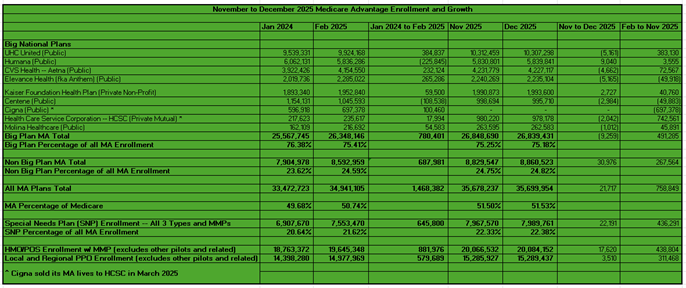

Shooting Stars: The Impact Of Regulatory Changes And What MA Plans Can Do

Note: This blog is published in partnership with Lilac Software. Learn more about Lilac’s Stars solutions at the link at the end of the blog. Seismic changes in Star ratings means MA plans need strategic planning and investments. Medicare Advantage (MA) plans continue to worry about the impacts of the proposed Stars regulatory changes and what they will mean to Star ratings and benefits in the future. This is occurring as the industry as a whole continues to struggle financially and has had to retrench from a geography, product, and benefit perspective. The major investment that has occurred has been in Special Needs Plans (SNPs) the past two years, but some of the regulatory changes do not bode well for Stars for plans that will have SNP lives or a high concentration of dual eligibles. Refresher on proposed changes Major measure realignment: Beginning primarily in Measure Year (MY) 2027 or