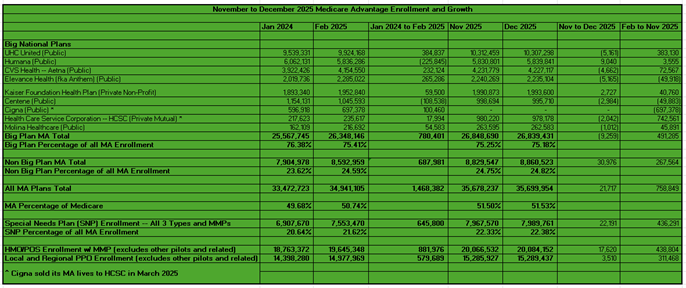

December Medicare Advantage Enrollment Growth

A quick blog to tell you about enrollment growth in Medicare Advantage (MA) in December 2025. The results show some interesting trends as we go into 2026. Many have predicted that MA enrollment could contract in 2026. I have said on a number of occasions that I doubted we would see that and instead see enrollment that is relatively flat or extremely small in terms of growth. I surmised that while most national plans want to see their enrollment contract by millions, I suspect regional plans will take on the challenge of enrolling robustly despite some financial risks. While it is too early to tell what will happen, we can read some tea leaves in the December data. What do the latest statistics show? Growth from January 2024 to February 2025 was 4.39% or 1.468 million. (I used February 2025 because of issues with the January 2025 statistics.) Enrollment in